Political pressure and legal threats are shaping the conflict between the US president and the US Federal Reserve. Why Trump is undermining his own goal with his escalating rhetoric.

US President Donald Trump is stepping up his attacks on the US Federal Reserve and is now even threatening Fed Chairman Powell with prosecution. Behind this is primarily his political goal of driving down US interest rates at any cost – even if it goes against economic logic.

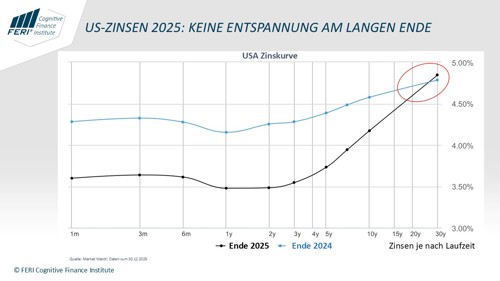

The US yield curve at the end of 2025 illustrates the central dilemma: although the Fed lowered key interest rates several times in 2025, interest rates on 30-year US bonds were actually higher than the previous year's level at 4.86%. This picture is more than an anomaly – it creates a serious political problem for Donald Trump.

What is behind this?

• 30-year mortgages in the US still cost over 6% interest – young families and first-time buyers in particular are feeling little relief despite the Fed's easing measures.

• This “housing affordability problem” is weighing on voter sentiment – highly problematic for the US government with a view to the 2026 midterm elections.

Trump's response: escalation on two fronts

US President Donald Trump is responding with escalation on two fronts. On the one hand, he is increasing political pressure on Fed Chairman Powell and also initiating legal threats. This frontal attack massively calls into question the institutional independence of the Federal Reserve.

On the other hand, there is talk of a possible purchase program worth around USD 200 billion by the semi-public mortgage financiers Fannie Mae and Freddie Mac – a brazen maneuver to indirectly force interest rates down.

Trump's dilemma: bitter irony

The more aggressive the political influence, the higher the inflation, risk, and confidence premiums demanded by the markets –especially at the long end of the yield curve.

Open political manipulation therefore leads to higher yields – and Trump's blatant attack on the Fed is driving up precisely the interest rates he wants to lower.