Venezuela's crude oil reserves and Canada's resources are fueling Trump's energy policy ambitions. A new “oil bloc” could be formed to counterbalance OPEC – with noticeable consequences for the global oil market, but to the benefit of the US economy.

Donald Trump's economic policy focus is on low interest rates and abundant oil at favorable prices. Against this backdrop, the recent US intervention in Venezuela is becoming increasingly controversial – as is Trump's desire to annex Canada. What is the common factor?

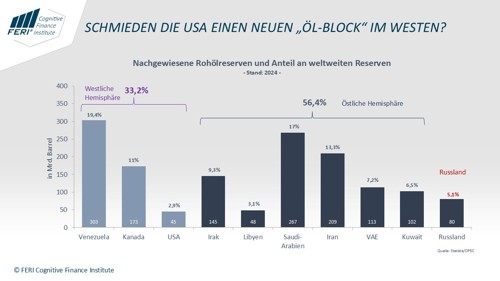

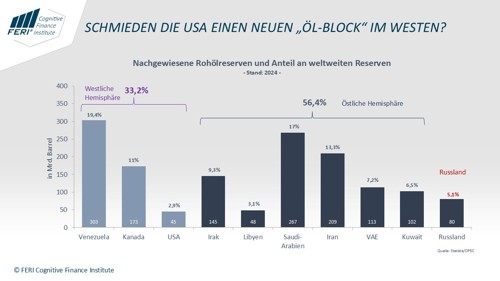

- Venezuela possesses nearly 20% of the world's crude oil reserves – more than Saudi Arabia! However, due to political instability and sanctions, this potential has remained untapped for decades.

- Although the US is currently the world's largest oil producer, it has comparatively low reserves, accounting for less than 3% of the global total – in contrast to Canada, which accounts for around 11%!

From the US perspective, this presents an attractive geopolitical opportunity:

- Combined with Canada's rich oil reserves, a contiguous energy corridor could be formed stretching from North to South America (see chart).

- Together with Venezuela and Canada, a powerful “oil empire” could emerge in the US hemisphere – led by major players in the US oil industry.

A new “oil bloc” as a strategic counterweight to OPEC – with noticeable consequences for global energy markets, but to the benefit of the US economy – would be the possible outcome.

For the time being, the following questions in particular remain open:

- Would such a plan by the US not only be conceivable – but also feasible?

- Would it result in greater stability in the global energy system – or a new risk factor?

- Could oil-rich Iran also come into play – for example, after US intervention?